What is depreciation Depreciation is a method of reduction that breaks down the expenses linked to a fixed assets long-term costs. Here is the formula to calculate amortization. Amortization is a method for decreasing an asset cost over a period of time. The amortization process for accounting purposes may be different from.

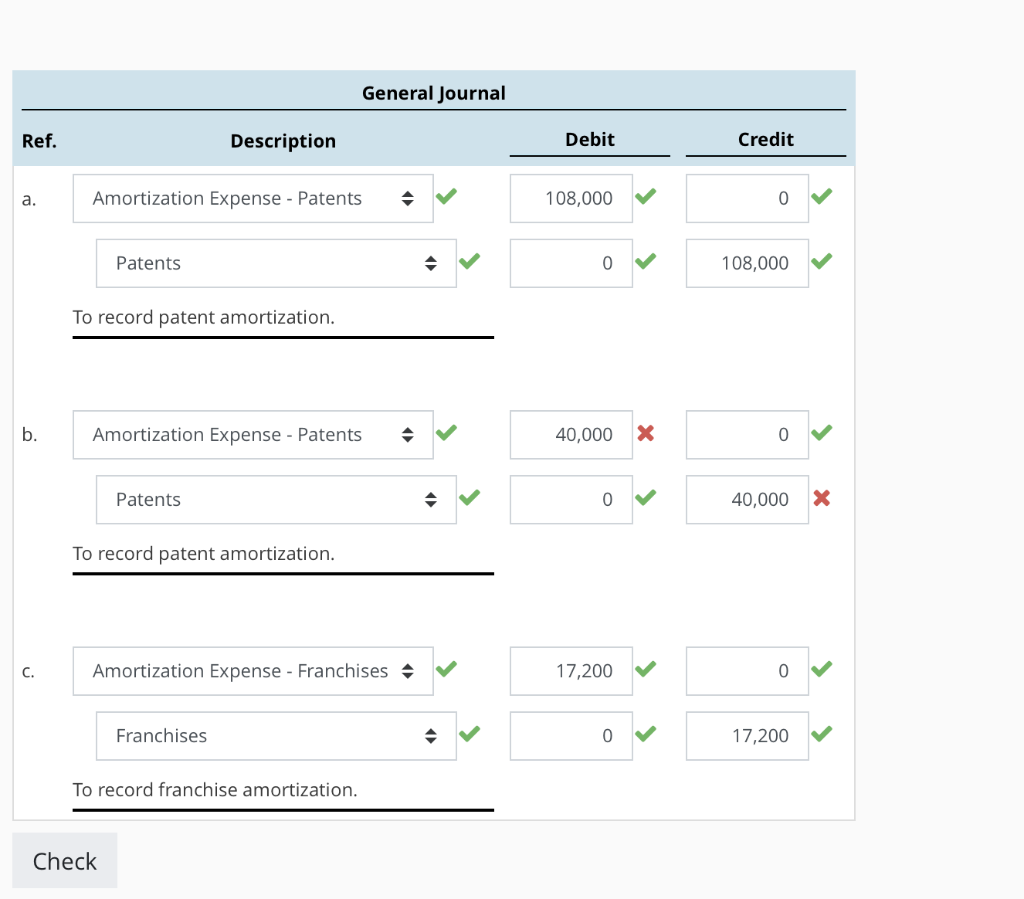

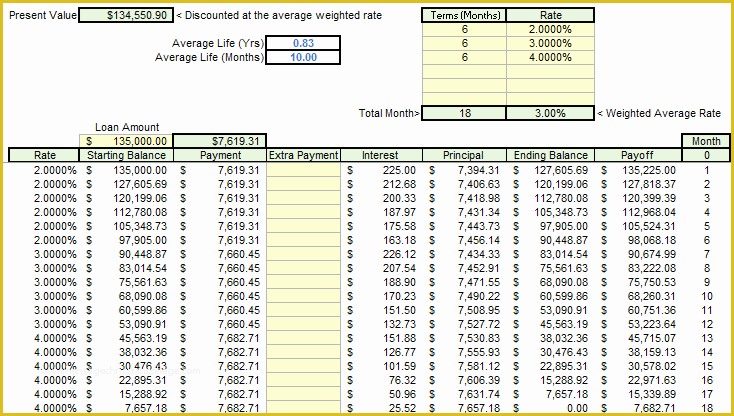

Is the federal or Wisconsin depreciation expense used. Amortization of intangibles is the process of expensing the cost of an intangible asset over the projected life of the asset. What formula do I use to calculate amortization? The amount of depreciation expense for federal and Wisconsin franchise/income tax purposes is different. What is the Amortization Expenses Amortization, in accounting, refers to the technique used by companies to lower the carrying value of either an intangible. Actual results could differ materially from those estimates. Interest to be paid (10 100,000) Interest Expense to be recorded (10.53 Preceding bond carrying value) Discount Amortization. We can prepare the bond discount amortization schedule as follows: Interest Periods. That means that the same amount is expensed in each period over the assets useful life. these assets to yield the annual post-transaction depreciation/amortization expense. The effective-interest rate is 10.53 and interest is payable on Jan. Amortization is typically expensed on a straight-line basis. The difference between amortization and depreciation is that amortization is used for intangible assets, while depreciation is used for tangible assets. of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Incremental Depreciation & Amortization M&A Model Macabacus. What is the difference between depreciation and amortization? Amortization practices reflect a more accurate cost of doing business in a company’s financial reporting, as the benefits of an initial expense may continue long after the initial report of that expense.Ī broader amortization definition includes the process of gradually paying off the loan balance over a set amount of monthly payments and in fixed increments, commonly seen in home mortgages and auto loans. The amounts of each increment of a spread-out expense as reported on a company’s financials define amortization expenses. Amortizing an expense is useful in determining the true benefit of a large expense as it generates revenue over time. In accounting, amortization refers to the practice of spreading out the expense of an asset over a period of time that typically coincides with the principle asset’s useful life.

0 kommentar(er)

0 kommentar(er)